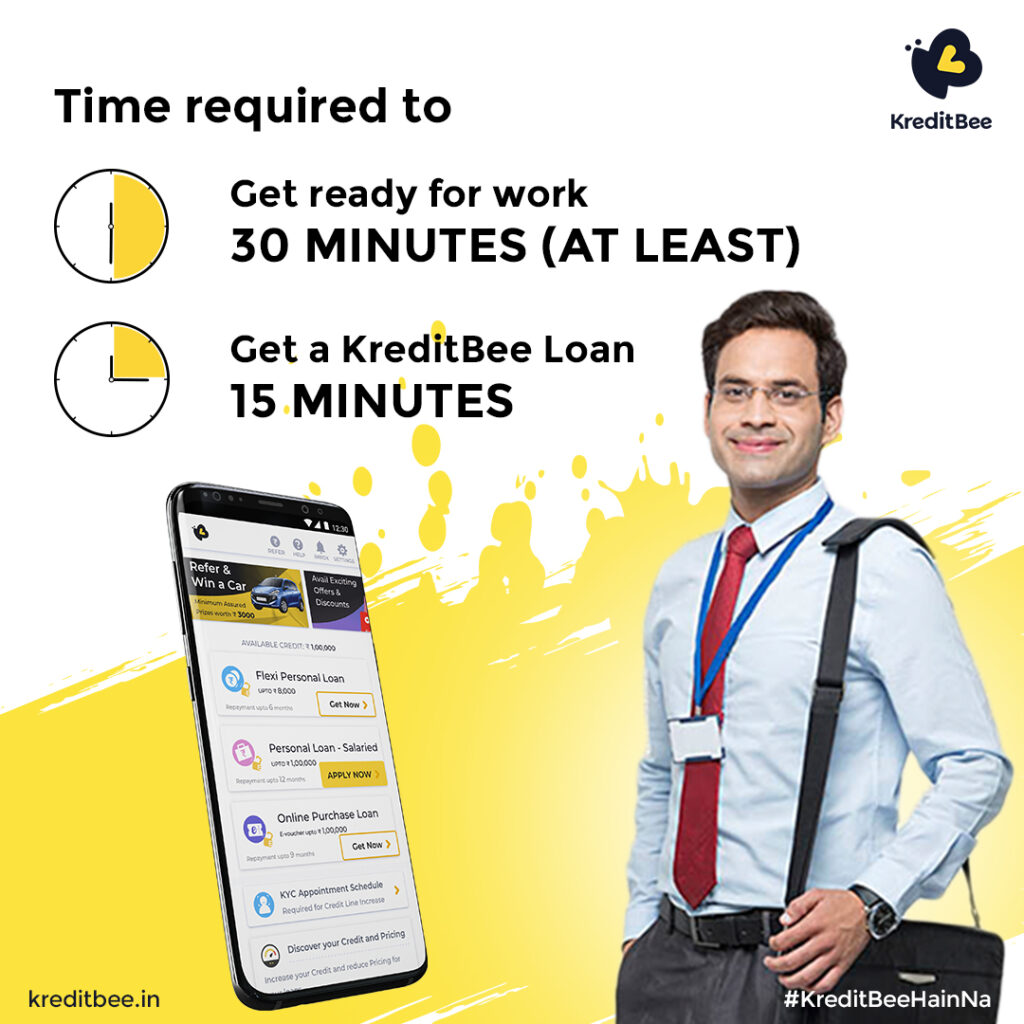

If your savings account is running low and you have some bills to pay urgently, quick loan apps are your bets. These apps allow you to get a quick personal loan with minimum documentation.

Plus, they are getting highly popular these days for their cutting-edge features, including quick disbursement, attractive cashback offers on referrals, and more.

Some apps also provide a flexi loan feature which is quite easy to acquire.

With the advancements in technology, it is easy to get a personal loan. Still, it is crucial to use that money wisely. In this article, we will talk about how you can use your personal loans wisely for proper financial growth.

Mentioned below are a few points that will help you utilize your personal loan money better for more financial growth:

Improving credit score and clearing pending bills

It is wise to take an instant loan online for paying off an existing debt, like a pending credit card bill. The interest rate charged by various credit card companies is more than the amount charged by personal loan platforms. But to get these loans, your credit score must be above 700. Paying credit bills on time will help you improve your credit score.

For big payments

Sometimes, your savings might not be enough to clear some big payments. For example, you need to pay money for a long vacation. In such cases, you can take a personal loan. However, you must be careful about the loan amount. Carefully evaluate resources to know if you can repay the loan amount in the given amount of time.

Make Investments

If you are looking for capital to use in various opportunities, taking instant loans online can be beneficial. You can use the money to invest in stocks, real estate, or even open a small business.

However, you must carefully assess the risks involved in the investment you are about to make. Suffering a huge loss will create more problems.

Ideal for Emergency Payments

Since most personal loan apps have the instant pay feature, you can quickly get the funds for emergency payments. Suppose your car needs sudden upgrading and the bill is too high, or you want to throw a big anniversary party for your significant other; in such cases, personal loans can be your perfect helping hand. However, you must be careful about the amount you are borrowing. Do not go overboard and take money, which you will have a tough time repaying.

Conclusion: The Bottom Line

Quick loans platforms can be a blessing if you know how to utilize them properly. Instead of using and spending the loan money recklessly, it is wise to invest it smartly so that later, you won’t have any issues returning the amount.

In the era of quick e-payments, do not waste personal loan money. Carefully consider the points mentioned in the article before spending your loan money in your savings account. Also, avoid taking loans that you won’t be able to repay, as it will impact your credit score and put you in a poor financial spot.