Financial literacy is an essential skill for youth. They should learn about it early in life, during their teenage years. It helps them learn the importance of saving money at an early age, and when they grow up, it can help them make the right money-related decisions.

With the rising cost of living, it has become very important for the coming generation to know the value of money. In this article, we will learn how to encourage the young generation to save money. So, let’s get started.

Practical ways to teach money saving practices to the young generation

Introduce the concept of Allowance:

One of the most effective ways to teach the young generation about money saving is by giving them an allowance. It could be a weekly or monthly amount; it provides them with the opportunity to manage their expenses and money. Discuss their weekly or monthly needs, categorize them, and provide them with the funds accordingly.

Let them make their budget. This will encourage them to save money from their allowance regularly. Here, the parents can introduce the concept of “saving jars” where they can save their money. This simple exercise can create an instant impact and will prepare them to save money in the future.

Set Saving Goals:

Another way to encourage the young generation to save money is to set saving goals. Encourage them to save for a device, a special outing, a gift for a friend, or any other tangible goal that can motivate them to save. This not only reinforces the importance of saving but also gives them a sense of accomplishment when they reach their goals.

Lead by Example:

The young generation learns a lot by observing the behavior of other people around them. Parents and teachers can set positive examples for them by showing good financial habits. Talking with them openly about the concepts of budgeting, saving, and making thoughtful purchasing decisions makes these concepts more relatable for them. Additionally, adults can introduce terms like cash advance, instant loans, etc. to teach them about safe money borrowing.

Involving them in simple financial decisions, such as comparing grocery store prices or buying home devices, can also help.

Teach the difference between needs & wants:

One of the most important lessons in financial education is understanding the difference between needs and wants. Teaching them to prioritize things over wants and needs helps them make better financial decisions.

For example, when they ask for anything (say, a bicycle), elders can use the opportunity to discuss whether it is something they need or just want. This encourages them to think critically about their purchases and consider whether they really need it or just want it. By teaching them the concept of wants and needs, they will be able to learn a lot about money saving.

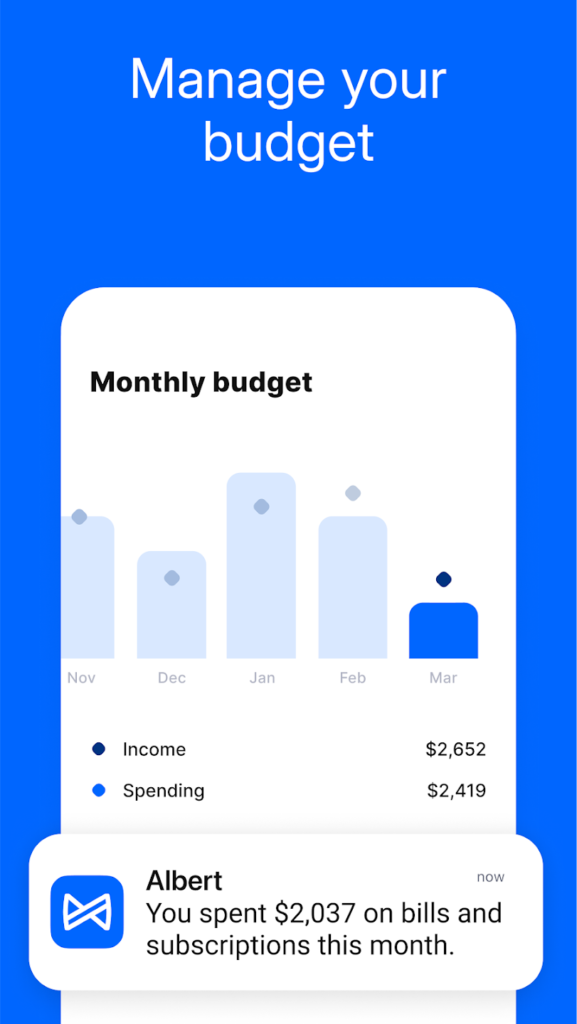

Additionally, parents can introduce platforms like Dave to the youth so that they can learn digital banking concepts and save more.

In conclusion:

Implementing money saving & safe money borrowing practices in the young generation is an investment for their future. By teaching them to save, parents and teachers equip them with the tools they need to make the right financial decisions throughout their lives.