In today’s fast-paced world, financial emergencies can occur at any moment. Whether it’s an unexpected medical expense, urgent home repair, or a sudden travel requirement, having access to immediate funds becomes crucial. This is where loans designed to manage sudden cash requirements play an essential role. Personal Loan Apps India and Loan App Online services offer quick solutions, making it easier to meet financial emergencies without affecting your long-term financial stability.

Understanding Loans for Sudden Cash Needs

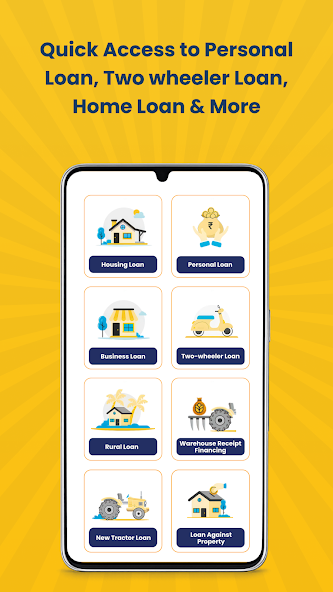

A loan is essentially a financial tool that allows individuals to borrow money for a specific purpose, with the promise of repayment over a predetermined period. When the need is urgent, traditional loan procedures may take time, which is why modern solutions like Personal Loan Apps India and Loan App Online are becoming increasingly popular. These platforms provide faster approval, minimal paperwork, and convenient repayment options, making them a practical choice for immediate financial support.

There are multiple types of loans available for sudden cash requirements:

1. Personal Loans

Personal loans are versatile financial solutions that do not require collateral. They can be used for a variety of purposes, such as medical emergencies, educational expenses, or urgent household repairs. With Personal Loan Apps India, the application process is simplified, allowing users to request and receive funds quickly.

2. Short-Term Loans

Short-term loans are designed for immediate financial relief. They generally have shorter repayment tenures and can cover emergency expenses efficiently. Many Loan App Online services now provide short-term loan options with competitive interest rates, ensuring borrowers have timely access to cash without long-term financial commitments.

3. Payday Loans

Payday loans are small, short-term loans that are usually repaid on the borrower’s next payday. They are suitable for sudden, unexpected expenses. While they often carry higher interest rates, the convenience and speed of processing make them a viable choice in urgent situations.

Benefits of Using Loan App Online Platforms

Digital loan applications have revolutionized access to credit. Using Loan App Online services comes with several advantages:

- Quick Approval: Most online loan apps provide near-instant approval based on basic personal and financial information.

- Minimal Documentation: Traditional loans often require extensive paperwork, but online platforms streamline the process.

- Accessibility: Loan apps can be accessed anytime, anywhere, offering flexibility in emergencies.

- Transparent Terms: Loan App Online platforms provide clear information on interest rates, repayment schedules, and applicable fees.

These benefits ensure borrowers can access funds swiftly while maintaining clarity on repayment obligations.

How to Apply for a Loan Online

Applying for a loan online through Personal Loan Apps India or other Loan App Online platforms is straightforward. Follow these steps for a smooth experience:

- Check Eligibility: Most apps have eligibility criteria based on age, income, and credit history. Ensure you meet the requirements before applying.

- Complete the Application: Fill in the necessary personal and financial details in the application form.

- Upload Documents: Submit scanned copies of identification, address proof, and income verification documents.

- Approval and Disbursement: Once the application is verified, funds are often disbursed directly into your bank account within 24-48 hours.

The convenience of online loan applications eliminates the need for in-person visits, saving both time and effort.

Factors to Consider Before Borrowing

While loans are helpful in emergencies, it’s essential to borrow responsibly. Consider the following factors before applying:

- Interest Rates: Compare rates across multiple Loan App Online platforms to ensure you get a fair deal.

- Repayment Tenure: Choose a repayment period that aligns with your financial capacity to avoid default.

- Processing Fees: Check for hidden charges or service fees that may increase the overall loan cost.

- Loan Amount: Only borrow the amount required to meet your immediate needs to prevent unnecessary financial strain.

Responsible borrowing ensures that loans provide temporary relief without creating long-term financial challenges.

Tips for Managing Loan Repayment

Proper planning is crucial to managing loans effectively. Here are some practical tips:

- Create a Repayment Schedule: Plan your monthly budget to accommodate loan installments.

- Automate Payments: Set up automatic payments through your bank to avoid late fees.

- Track Loan Balance: Regularly check your outstanding balance and remaining tenure.

- Avoid Over-Borrowing: Only take the loan amount necessary for the emergency to minimize interest costs.

By following these strategies, borrowers can use loans as a reliable financial tool without experiencing undue stress.

When to Use Loans for Emergencies

Loans should be considered primarily for urgent and unavoidable expenses. Common scenarios include:

- Medical Emergencies: Sudden medical treatments, surgeries, or hospital bills.

- Home Repairs: Unexpected damage due to natural events or accidents.

- Educational Needs: Fees for immediate academic requirements.

- Travel Emergencies: Urgent travel for personal or professional reasons.

In these situations, Personal Loan Apps India and Loan App Online platforms offer timely solutions, ensuring financial emergencies are managed effectively.

Advantages of Digital Loan Platforms

The rise of digital financial services has simplified the borrowing process significantly. Some key advantages include:

- Speed: Applications can be completed and approved within hours.

- Convenience: Borrowers can access multiple loan options from a single app.

- Security: Advanced encryption ensures personal and financial data are protected.

- Flexibility: Various repayment options cater to different income patterns.

Digital platforms have transformed the way loans are applied for, making financial support accessible for all.

Conclusion

Loans have become an indispensable tool for managing sudden cash requirements. With the emergence of Personal Loan Apps India and Loan App Online platforms, accessing funds has never been easier. These digital solutions offer quick approval, minimal documentation, and flexible repayment options, allowing individuals to meet emergencies without disrupting their long-term financial plans.

By borrowing responsibly, comparing interest rates, and planning repayment schedules, loans can provide immediate relief while maintaining financial stability. Whether it’s a medical emergency, urgent travel, or unexpected household repair, loans offer a practical solution for sudden financial needs.

Explore Personal Loan Apps India or Loan App Online today and ensure you are prepared for any unexpected financial situation. With careful planning and responsible borrowing, loans can be an effective tool to manage sudden cash requirements with ease and confidence.