Investing in the stock market has undergone a major transformation in India. Once dominated by traditional brokerage firms, the landscape now includes advanced Share Market Apps that allow investors to trade directly from their smartphones. These mobile applications have changed how people invest, track portfolios, and manage their Demat Accounts. This article compares Indian stock trading apps with traditional brokerage platforms, analyzing their advantages, limitations, and the impact they have on modern investing behavior.

The Evolution of Trading in India

Trading in India has evolved from manual transactions to a digital-first environment. Earlier, investors had to depend heavily on brokers for placing orders, understanding market trends, and managing paperwork related to share ownership. With the introduction of Demat Accounts, the need for physical share certificates disappeared, making trading more efficient and transparent.

Today, Share Market Apps have taken this progress even further. These mobile platforms provide instant access to the stock market, enabling users to buy, sell, and track investments anytime. The evolution has made investing more inclusive, especially for young professionals and beginners who seek convenience and control.

Accessibility and User Experience

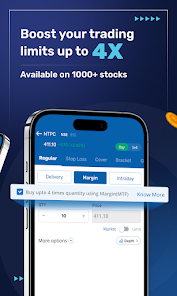

Traditional brokerage platforms often required investors to call or visit their brokers for every transaction. This process was time-consuming and often involved additional communication delays. In contrast, Indian stock trading apps provide a seamless interface where everything—from opening a Demat Account to executing a trade—can be done digitally within minutes.

The intuitive layout of these apps ensures that even first-time investors can navigate them easily. They offer market updates, stock screeners, and educational insights all in one place. The accessibility of these apps has helped bridge the gap between experienced traders and newcomers, giving everyone a fair opportunity to participate in the market.

Cost Structure and Brokerage Fees

One of the most noticeable differences between stock trading apps and traditional brokers lies in their fee structures. Conventional brokers often charge higher commissions per trade, making frequent trading costly. Moreover, hidden charges were sometimes added for advisory or maintenance services.

Modern Share Market Apps, on the other hand, typically offer low-cost or flat-fee models. This transparent pricing helps investors save significantly over time. With fewer intermediaries, transaction costs are reduced, allowing users to focus more on investment growth rather than overhead expenses.

Speed and Efficiency of Transactions

In the traditional setup, order execution depended on brokers manually entering trades, which could lead to delays, especially during high-volume trading periods. Indian stock trading apps have automated this process. Orders are executed instantly, giving investors better control over entry and exit points.

Instant fund transfers, real-time portfolio tracking, and live market updates make trading faster and more efficient. This level of automation not only improves accuracy but also enhances investor confidence, as they can respond quickly to changing market conditions.

Research and Market Insights

Traditional brokerage platforms often provided research reports through dedicated analysts. While this information was valuable, it was not always accessible to smaller investors or those unwilling to pay extra for advisory services.

With Share Market Apps, research tools are built into the platform itself. Users can access historical charts, performance data, and technical indicators without relying on external sources. Many apps also provide learning sections that explain market concepts, making investors more informed and self-reliant.

Security and Data Protection

Security remains a top concern for investors. In the past, traditional brokers stored client data in physical or partially digital systems, which carried a risk of data breaches or manual errors. Today’s Demat Account system, integrated with trading apps, follows strict security protocols to protect financial data.

Trading apps use encryption, two-factor authentication, and biometric logins to ensure user privacy. Regulatory bodies in India also enforce compliance guidelines, making online trading secure and trustworthy.

Transparency and Control

Traditional brokerage platforms often limited investor visibility into the process. Investors relied on brokers for trade confirmations, portfolio summaries, and financial statements. With trading apps, transparency has improved drastically.

Every trade, statement, and performance report is available in real-time. Investors can independently analyze their holdings, review past performance, and track gains or losses at a glance. This transparency encourages disciplined trading and smarter financial planning.

Education and Self-Learning

The modern Indian investor is more informed and proactive. Trading apps cater to this trend by offering tutorials, webinars, and demo accounts. These resources allow users to learn trading basics, understand risk management, and explore investment strategies at their own pace.

Traditional brokers, while knowledgeable, usually offered such insights through paid advisory sessions. By making financial education more accessible, Share Market Apps contribute to long-term investor empowerment.

Reliability and Customer Support

While technology has simplified trading, human support still plays an important role. Traditional brokers provided direct personal interaction, something many investors found reassuring. Trading apps, however, are bridging this gap through chat support, AI-driven help centers, and dedicated customer service lines.

Although face-to-face consultations are less common now, digital support systems have become faster and more consistent. Issues like account updates or Demat Account linking can be resolved within minutes through in-app assistance.

Future of Trading in India

The future of trading in India points toward complete digitalization. As smartphone penetration and internet connectivity grow, Share Market Apps are likely to dominate investment channels. These platforms are continuously evolving—introducing automation, advanced analytics, and AI-based trading suggestions that simplify decision-making.

Meanwhile, traditional brokerage firms are adapting by building hybrid systems that combine personal advisory with digital convenience. Investors today prefer flexibility, and platforms that balance both personal touch and digital ease will define the next generation of trading in India.

Conclusion

The comparison between Indian Stock Trading Apps and traditional brokerage platforms reveals a clear shift toward convenience, speed, and transparency. While traditional brokers offered personalized service, they often came with higher costs and slower processes. On the other hand, Share Market Apps empower investors with control, lower fees, and real-time insights.

The integration of Demat Accounts with mobile trading systems has made investing smoother than ever. Whether you are a seasoned trader or a beginner, the digital shift provides a more accessible and cost-efficient way to participate in the stock market.

In the end, the rise of Indian stock trading apps represents more than just a technological shift—it reflects a cultural transformation in how Indians view, manage, and grow their wealth.