Want to do intraday trading? But don’t know how to start. Intraday trading means buying and selling financial instruments on the same day. It required quick decisions, technical analysis, and real-time market data. If it sounds difficult, you can make it simple by using mobile trading apps. Let’s talk about some strategies that will help you to become an excellent intraday trader.

Selecting the right App

- Choose apps that provide real-time market quotes, price charts, and news updates.

- Always Look for apps with advanced charting capabilities, including technical indicators and drawing tools.

- Speed is crucial in intraday trading. An app known for fast order execution and minimal latency would help.

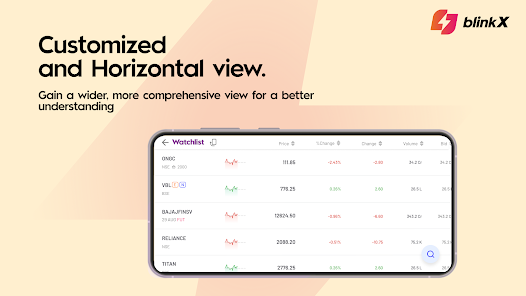

- Customizable layouts can help traders prioritize key information.

- You can even start with a free trading app that saves you money and helps in your continuous journey.

Follow the Trend

- Use moving averages, trend lines, and momentum indicators to spot trends.

- When you trade, go with the current trend to take advantage of price movements going in that direction.

- Watch the average price over a longer period to see how strong the trend is.

Breakout Trading

- Look for price levels where prices break out or drop sharply.

- Check trading volume and volatility indicators to confirm these movements.

- Must Wait for the price to retest the breakout level so that you can take the next move.

Scalping:

- Execute multiple trades within short timeframes to capitalize on small price movements.

- You should focus on liquid stocks with tight bid-ask spreads for efficient scalping.

- Utilize tick charts or one-minute charts for precise timing of entries and exits.

- You can also use limit orders to enter and exit trades quickly at desired price levels.

News-Based Trading

- Consider the market reaction to previous similar news events on the best share market app to anticipate price movements.

- Use apps with up-to-date news and economic calendars to stay informed.

- Think about how the market has reacted to similar news in the past to predict price changes.

- Set stop-loss orders to limit losses if news has unexpected effects on the market.

Check on the Price Gap

- Analyzing the price gap between the previous day’s closing price and the current day’s closing price will help you make decisions.

- Use gap analysis and volume confirmation to determine entry and exit points.

- Wait for a partial fill of the gap to confirm the direction of the trade.

- Consider the size of the gap relative to average price movements to gauge potential profit.

Pattern Helps

- Recognize chart patterns such as flags, triangles, and head and shoulders formations.

- Trade based on pattern breakout or breakdown, combined with volume analysis for confirmation.

Breakout and Pullback:

- Identify breakout patterns followed by pullbacks to key support or resistance levels.

- Enter trades on pullback confirmation, with stop-loss orders placed below support or above resistance.

Risk Management Strategies

- You must calculate position sizes based on risk tolerance and stop-loss levels.

- Avoid overleveraging to preserve trading capital during volatile market conditions.

- Spread risk across multiple trades and asset classes to reduce portfolio volatility.

- Don’t invest the whole capital in a single position or sector.

In conclusion, using investment apps in India can help traders succeed in the stock market. Making decisions wisely and keeping all the points in this article will help you to achieve your desired goal. With these strategies, you can master intraday trading.